Direct Deposit Authorisation Form

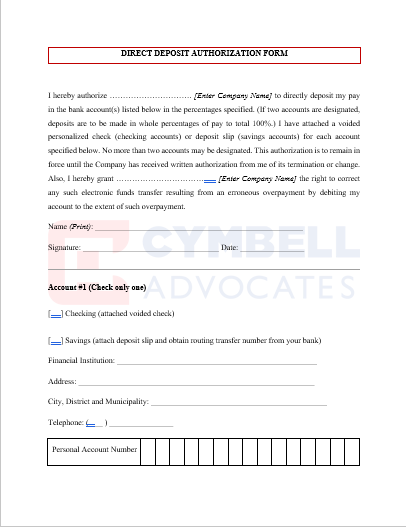

A direct deposit authorization form is a document that authorizes a third (3rd) party, usually an employer for payroll, to send money to a bank account by entering the account name, routing transfer number, and account number. Sometimes the employer will require a voided check to ensure that the account is valid.

Direct deposits cut out the paycheck’s middleman. Instead of receiving a physical check and depositing it into the account yourself, you can set up a direct deposit with your employer so your pay transfers directly to your designated account on payday. While setting direct deposit up is simple enough, there are documents you will need beforehand.

The first step in setting up direct deposit at work is to get the direct deposit form from your employer, either as a physical or electronic copy. While most employers can easily supply you with the form, some might not have it on hand. In this case, some banks and credit unions may have a form that you can download or complete online or physically fill out at the bank..

Once you have obtained the form, you will need the following information to fill it out: your bank’s mailing address, the bank’s routing transfer number, your account number and the type of account you will be depositing to. Some forms might ask for your Social Security number or mailing address. You should be able to find your bank’s mailing address either online or on a bank statement. If you received the form from the bank and not your employer, you will most likely need to supply the employer’s address as well.

You should be able to find the bank’s routing transfer number on a bank statement or at the bottom of your checks. Your account number follows the bank’s routing transfer number on the bottom of the check. Lastly, determine the type of account you wish to deposit to. This could be either your checking or savings account. You will most likely need to note this on the paperwork.

Once you fill out the form with the necessary information, determine how much of your paycheck you wish to have deposited into your account at the end of each pay period. Whether you want to put 100 percent of the amount into one account or split it up is up to you. For example, 20 percent could go into your savings and the rest into checking.

UGX50,000

Get your

Direct Deposit Authorisation Form

Instant Download

- Up-to-date document template

- Emailed to you instantly

- Suitable for startups and small-to-medium businesses

- Editable Word Document for you to modify

- Guidance notes included

UGX50,000

Drafted By An Advocate

- Document drafted by a lawyer

- Up to five business day turnaround

- Complimentary consultation with a lawyer to discuss changes and answer questions

- Fully personalised for your business and industry

- You are protected under our insurance

Affordable Fixed-Fee Price

Table of Contents

CM Advocates LLP Service Agreement template sets out:

- the terms of the relationship;

- the rights, responsibilities and obligations of the service provider and principal; and

- business processes such as payment, fees and invoicing.

- an unpaid invoices collection clause;

- a confidentiality clause;

- the ability for the service provider to be paid on commission;

- a subcontracting clause allowing the principal to restrict the ability of the service provider to subcontract the services;

- a sophisticated dispute resolution clause;

- a sophisticated workplace health and safety clause;

- a non-compete clause;

- a provision to protect your intellectual property and to allow the service provider to use it, if required; and

- additional provisions in related to the rights, responsibilities and obligations of the service provider and principal, particularly if agreement has been reached on particular issues.